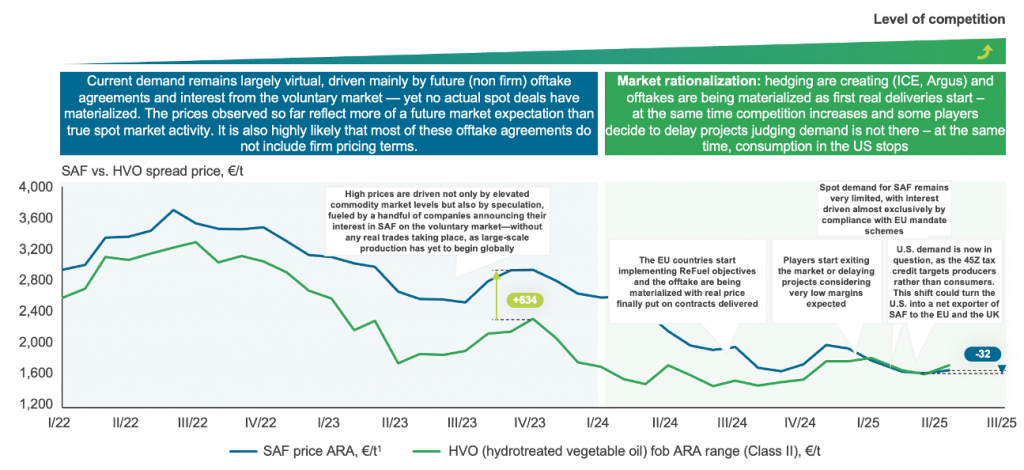

Paradoxically, the sustainable aviation fuel (SAF) bubble seems on the verge of bursting… before it has even truly taken off. While the first physical flows of HEFA-type SAF only emerged about a year ago—driven by enthusiasm for decarbonizing air transport and major voluntary programs like CORSIA and the Paris Agreements—the market is struggling to find solid economic footing.

Europe’s unique approach to walking makes it unique in that it limits its political and global agglomeration forces.

A Market Almost Entirely Dependent on Regulatory Mandates

Today, the only structured market for SAF is European, supported by an incorporation mandate set at 2% in 2025, and expected to reach 6% in 2030 under the ReFuelEU program. Outside of this regulatory framework, almost no viable outlet exists for SAF, the cost of which remains significantly higher than that of fossil kerosene (Jet fuel-A1: USD 670 per ton vs. SAF: USD 1,800 per ton).

In October 2023, the official adoption of ReFuelEU Aviation confirmed this trajectory: European fuel suppliers will have to integrate 2% of SAF into aviation fuel from 2025, with a target of 6% by 2030.

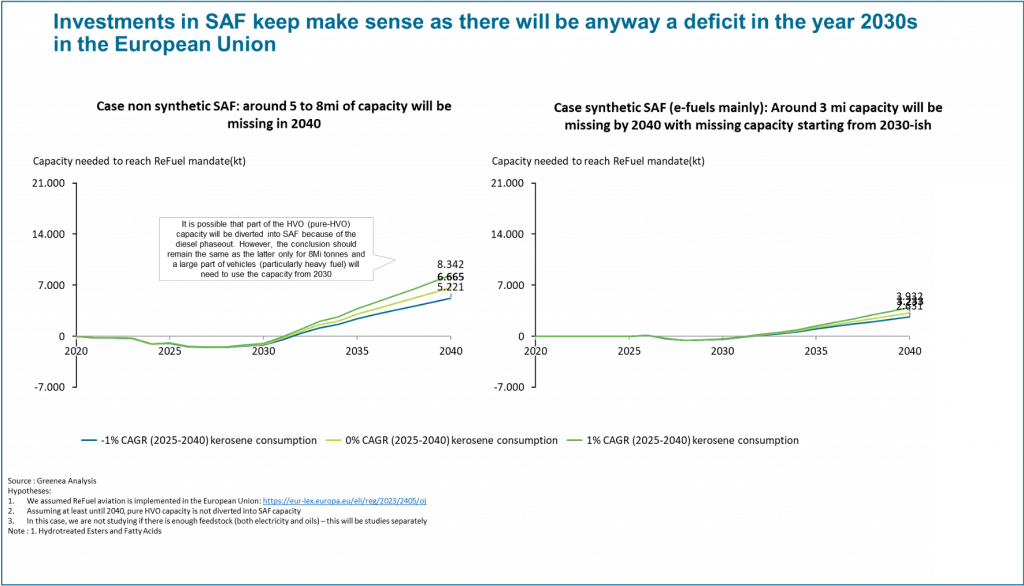

This represents approximately 0.9 million tonnes by 2025, then 2.8 million tonnes in 2030. The United Kingdom, for its part, unveiled the final details of its own mandate on April 30, 2024: 2% in 2025, with a ramp-up to 10% in 2030, representing an estimated demand of 1.2 million tonnes. These two areas are currently the only markets where demand for SAF is truly regulated, although it remains limited in view of the colossal investments launched worldwide. In the rest of the world, there is currently no region with stated objectives.

A Booming Supply in every continent, but a Nascent Demand

Yet, the production capacities announced by industry players for the coming years far exceed the needs driven by European mandates. In Asia, existing SAF production capacity already surpasses European demand, and new investments continue to pour in. Execution speed is striking: in many cases, less than 24 months separate the investment decision from the commissioning of a SAF plant.

The result is a latent overcapacity, with facilities that could soon become underutilized—or even significantly loss-making—in the medium term. In response to this imbalance, the entire industry is betting on the development of a voluntary market… which is struggling to take off.

The Voluntary Market Reaches Its Limits

In the context of the voluntary market, a company can choose to pay more for air transport in order to reduce its carbon emissions, as part of a compensation strategy or corporate social responsibility approach. However, this dynamic faces two major obstacles: it either directly reduces the company’s margins or increases the price paid by the end customer. In an uncertain economic climate, this approach appears neither sustainable nor scalable in the short term, especially with a fuel that costs more than 2.5 times the price of kerosene.

The lack of firm « take-or-pay » contracts in most of the SAF partnerships announced so far adds to the uncertainty: many of these agreements are merely statements of intent, with no concrete commercial commitments. As investors become increasingly aware of the disconnect between public messaging and commercial reality, the risk of a market backlash is growing.

Warning Signs Also Emerge from the United States

Across the Atlantic, uncertainties are piling up. Recent changes to the 45Z tax credit could transform the U.S. into a net exporter to Europe and the UK. A scenario that would further strain an already fragile European market, where SAF demand remains marginal.

Producers who had banked on U.S. exports must now rethink their strategies, while U.S. players question whether it even makes sense to ship volumes to Europe. The outcome? A global oversupply of SAF, with insufficient demand to absorb it in the near term.

An Imminent Zone of Turbulence

What do you do when turbulence is clearly ahead? The SAF market is very likely heading toward overproduction over the next five years. Investments have been massive, buoyed by upcoming regulatory mandates and the hope of a robust voluntary market. Several more projects are still being financed or built. But the industry is about to enter a phase of financial tension.

For some, this will be an opportunity: to acquire distressed assets at reduced prices, or to forge strategic partnerships under favorable terms. For others, the years ahead may be particularly painful. How can they hold out until demand finally catches up? Cost reductions, temporary shutdowns, asset sales, or capital raises—every option will be on the table.

A Two-Speed Sector: Between Consolidation and Repositioning

In this landscape, pure SAF players—those specialized exclusively in sustainable aviation fuel—are likely to face significant financial challenges. Some may be forced to suspend operations or seek consolidation.

In contrast, oil majors, better equipped financially and supported by diversified business portfolios, are well positioned to emerge as winners during this turbulent phase.

Their business models are not solely dependent on the immediate profitability of SAF assets. Moreover, they already control the kerosene supply chain in most airports—a decisive strategic advantage, since owning the downstream means owning the demand, and securing SAF offtake.

A Potential Bright Spot: RED III Implementation

The only tangible near-term glimmer of hope lies in the national implementation of the RED III directive, which could boost mandatory demand starting in 2026. A blending rate increase to 3% could slowly revive momentum. But this scenario will require patience and resilience from investors, as margins are likely to remain thin until at least 2030.

Between Thwarted Takeoff and Tarmac Realities

At a time when SAF embodies both climate hopes and industrial ambitions, the industry is facing a harder truth: constrained demand, limited markets, and an already oversaturated supply. The green promise of sustainable aviation fuel risks turning into an economic letdown unless market players quickly adjust their course.

In this uncertain context, GREENEA stands alongside producers, investors, airlines, and institutions to help them navigate with clarity—analyzing trends, identifying weak signals, and fine-tuning procurement strategies in line with actual market dynamics.